The microtechnology industry in Europe expects virtually no positive impulses from Brexit, neither for the industry nor for individual businesses. Industry representatives assume mostly negative economic effects. The results of a survey conducted by the IVAM Microtechnology Network shortly before the exit date more than anything else reflect the uncertainty about the future economic relations between Great Britain and the European Union after Brexit.

Outlook has worsened since “leave” vote

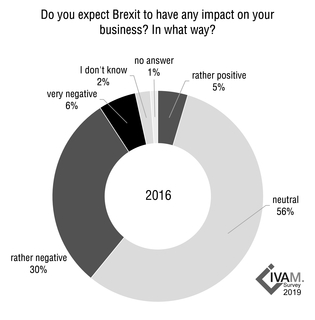

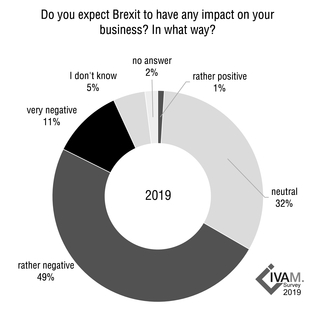

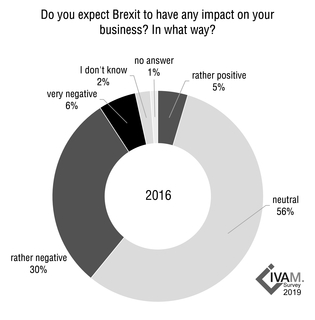

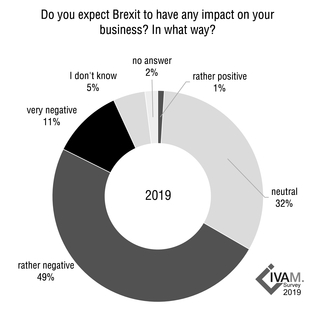

In the course of its economic data survey, the industry association IVAM has asked the industry about the expected impact of Brexit, as it did once before in 2016, before the vote that turned Brexit from a possibility into a fact. In 2019, shortly before the originally agreed upon exit date, the industry is much more pessimistic. Expectations, especially for the British industry, have invariably worsened since 2016, because the conditions for Britain’s withdrawal are still not negotiated.

Majority expects negative impact on business

Although the effects of Brexit are expected to be relatively moderate in the rest of the EU, almost 60% of the microtechnology industry representatives still fear a negative impact on their own business. In 2016, it was only 36%. However, these fears are not reflected notably in the growth expectations of the companies, which were identified in the same survey. In the United Kingdom, no one expects a positive effect on their business at present – in 2016, some respondents still had positive expectations.

According to research by the World Monetory Fund, manufacturing sectors like the chemical and transport equipment industry would be particularly affected by increasing trade barriers and because of their close integration into European production and supply chains, which might be disrupted by Brexit. This would also affect the microtechnology companies that are subcontractors to these manufacturing industries.

Uncertainty slows down British industry: investment put on hold

Uncertainty slows down British industry: investment put on hold

The uncertainty is above all bothering the British industry. As long as the framework conditions for foreign trade relations remain unestablished, decisions and investments are postponed. Even if an agreement between the UK and the EU were soon reached, certain damage to business would not be averted, a survey participant from the UK comments.

Capital investment in the UK has already declined as a consequence of the Brexit vote, according to various economic reports. Expectations of the microtechnology industry regarding investment, too, have clearly dropped since 2016: then just under half of respondents said Brexit would have a negative impact on investment in the UK; in 2019, it is more than 80%.

Trade under difficult conditions: bureaucratic load increases in all of Europe

Trade relations between Great Britain and the European Union will very likely be regulated more strongly after Brexit. Britain’s independence is expected to put a higher bureaucratic load on companies in both regions, the UK and the European Union. While in 2016 a negative impact of Brexit on regulations was predicted mostly for the industry in the United Kingdom, respondents now also expect the industry in the remaining EU countries to face more bureaucracy.

Among the British industry representatives a large majority today expect a higher bureaucratic load for the industry in their own country. In 2016, expectations were balanced. It now seems to have become clearer that Britain, detached from the EU, will not be able to act as autonomously as Brexit campaigners are propagating – especially in case of a “no deal” Brexit.

Dwindling hope for favorable trade agreements

While negotiations between the UK and the EU have reached a dead end, hope of a deal that could give Britain some benefits of EU membership is dwindling. The prospect of a trade agreement between the UK and the EU was rated as rather low in 2016 already by more than half of microtechnology industry representatives, today almost two thirds of respondents see a poor chance.

Regarding agreements between the UK and non-European countries, the industry is more optimistic – but still more pessimistic than three years ago. The odds that Britain will be able to negotiate favorable trade agreements outside the EU were rated as low by just under 14% in 2016, today it is just over 30%. Britain will certainly need to renegotiate or expand its international trade relations on many frontiers.