Favorite (7)

Favorite (7)

The term of the survey has overlapped with the beginning of the war in Ukraine - but does not lose its relevance because, on the one hand, the status quo of the organizations after the Corona pandemic is presented and, on the other hand, the special areas queried (sustainability/new German federal government) can also be considered independently of current developments.

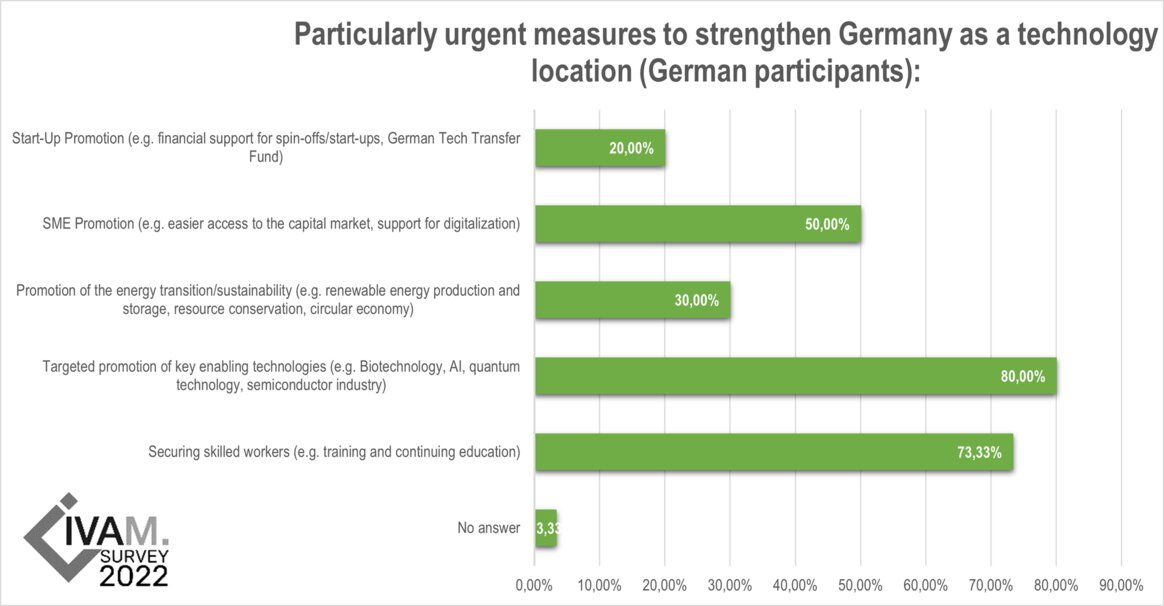

The points of targeted promotion of key enabling technologies (e.g. biotechnology, AI, quantum technology or semiconductor industry) and the issue of securing skilled workers are perceived as particularly urgent. 80% or 73.3% of respondents agree with this point.

There are numerous other expectations of the new federal government. Outstanding, however, is the desire for solutions to existing problems that have been exacerbated by the pandemic. Again, the "fight against the shortage of skilled workers" is addressed. Furthermore, reference is made to the "insourcing of key technologies to secure an independent supply situation" - the problems relating to supply chains lead to the desire for more production at home.

The topics of necessary investments in education and research as well as an increase in funds for research funding were addressed. Other mentions are aimed at securing Germany as a business location in the long term - even beyond the legislative period. The "expansion of the digital infrastructure", the "promotion of sustainability and climate neutrality", the "presentation of long-term goals to strengthen the economy (due to the demise of the automotive industry) and the "securing of the future of energy supply" were mentioned here.

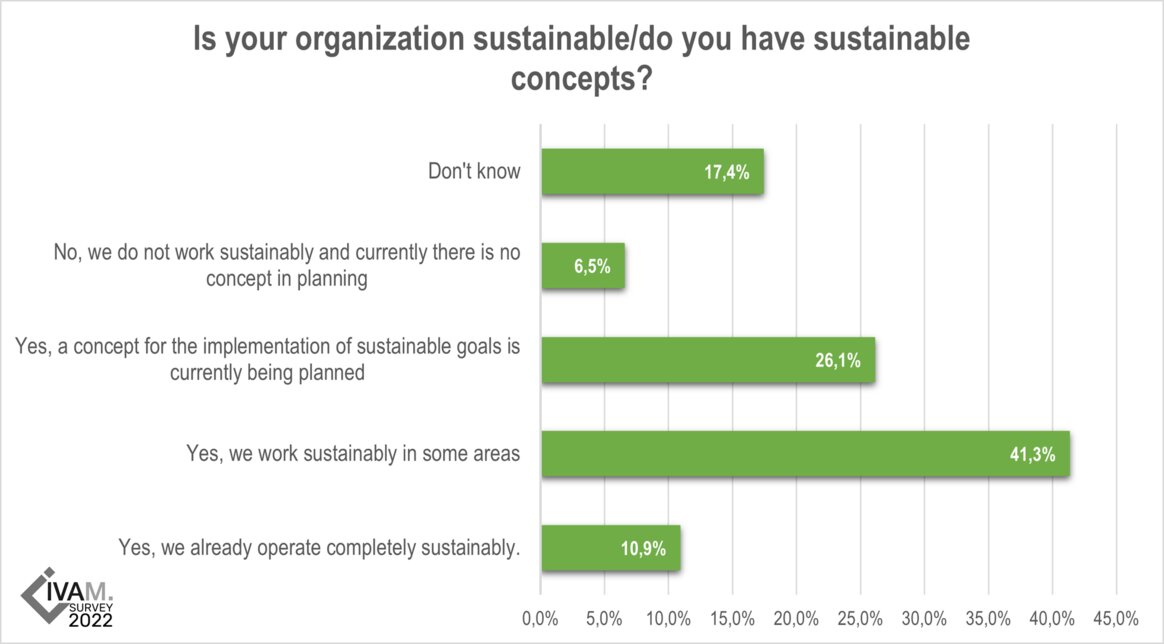

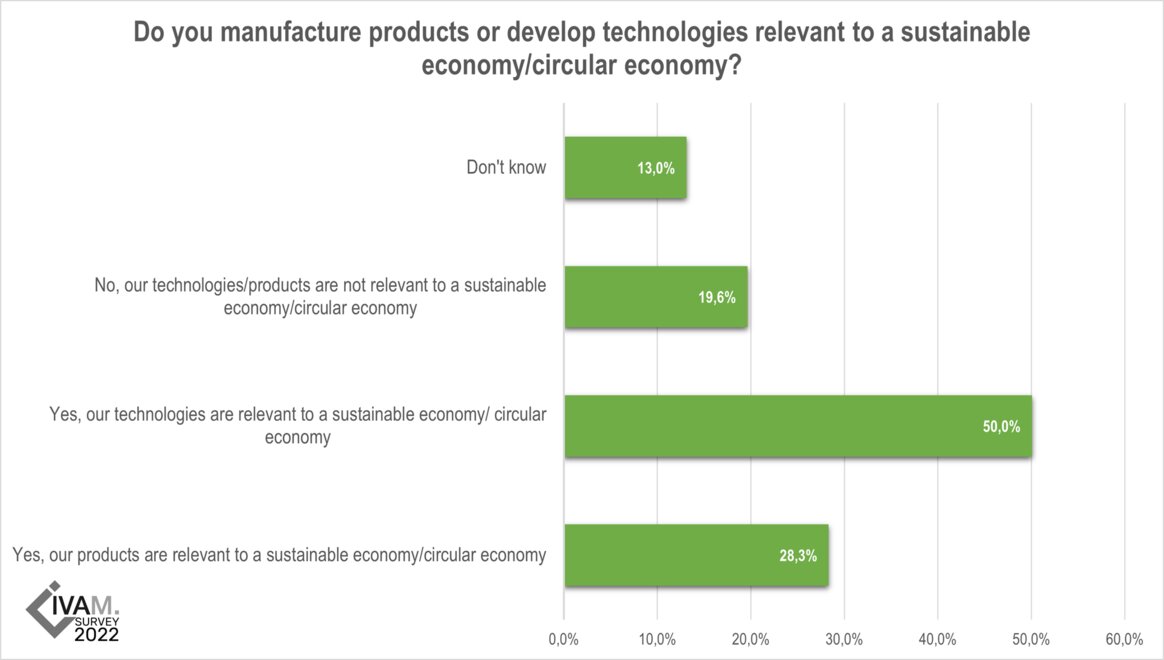

The topic of sustainability and the circular economy is already firmly anchored in the minds of the majority of respondents. Around 78% of respondents stated that they were currently planning at least one sustainability concept, if not already working completely sustainably. Regarding the technologies or products they produce themselves, 50% stated that their technologies are relevant to a sustainable economy or circular economy. In the case of products, 28.3% of the organizations assign their developments to this market.

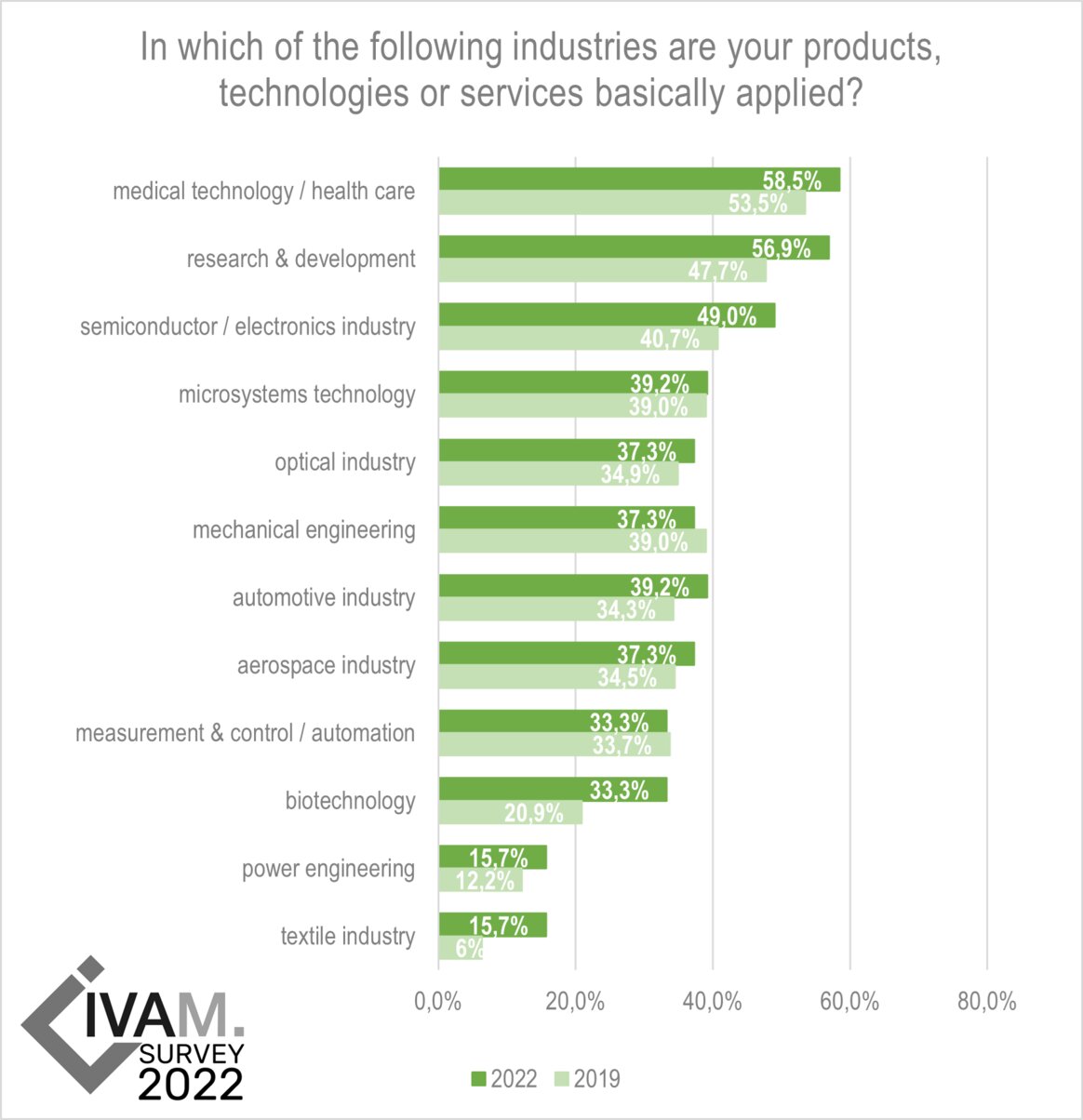

The survey on the main use of the organizations' products, technologies and services reveals a broad spectrum of fields of application, with medical technology (58.5%) and research and development (56.9%) being the most strongly represented. The field of biotechnology in particular has increased (33.3% compared to 20.9% in 2019) likewise the textile industry is now mentioned more frequently as a field of application compared to 2019 (15.7%).

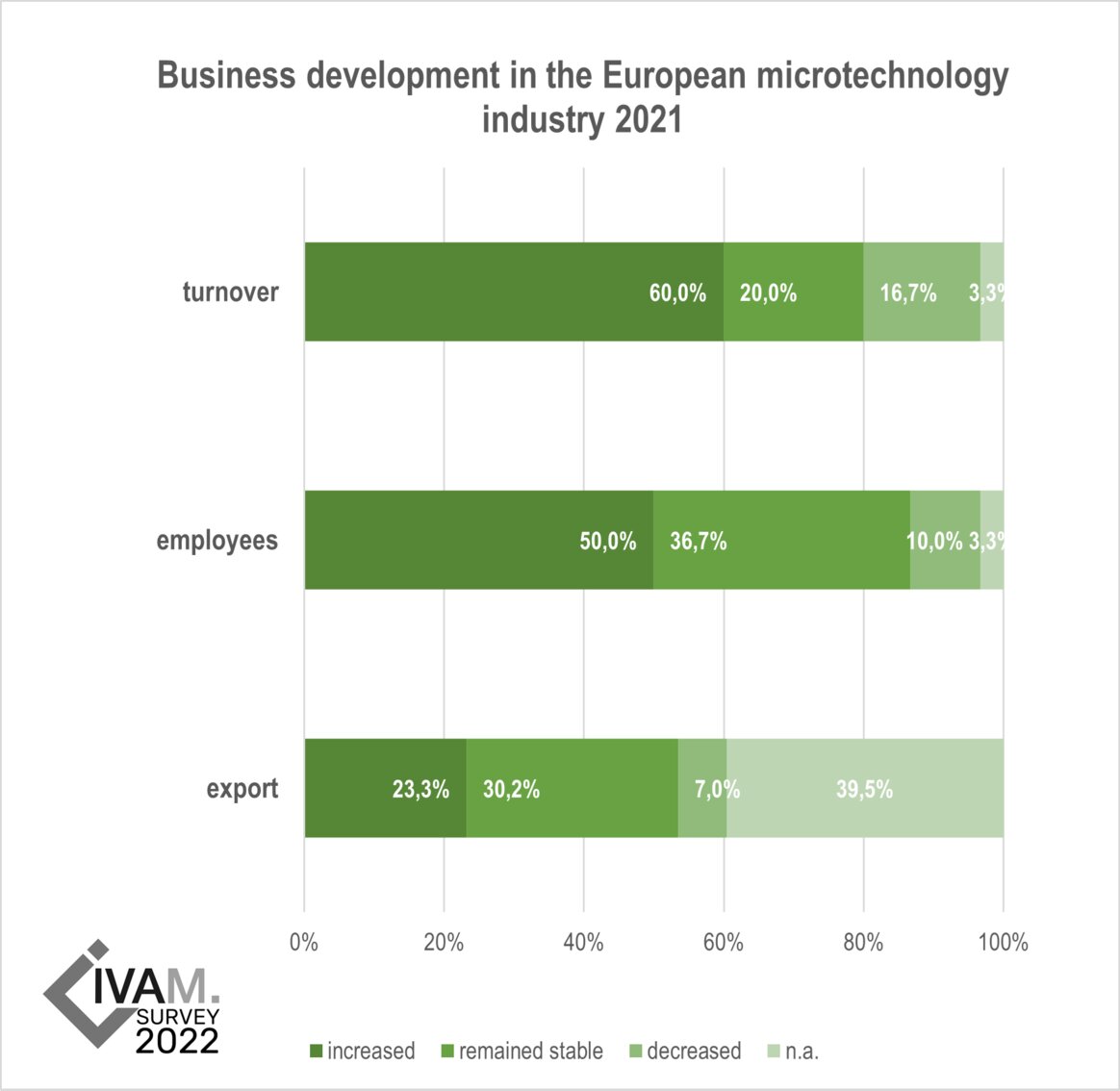

The majority of the companies surveyed (60%) achieved sales growth last year compared with 2020, while a further 20% stated that sales had at least remained stable. This is also evident with regard to the development of employee numbers. 50% of respondents indicated that the number of employees increased in 2021 compared to the previous year. For 36.7%, the number of employees at least remained constant. It is striking that exports have increased for only 23.3% of the respondents.

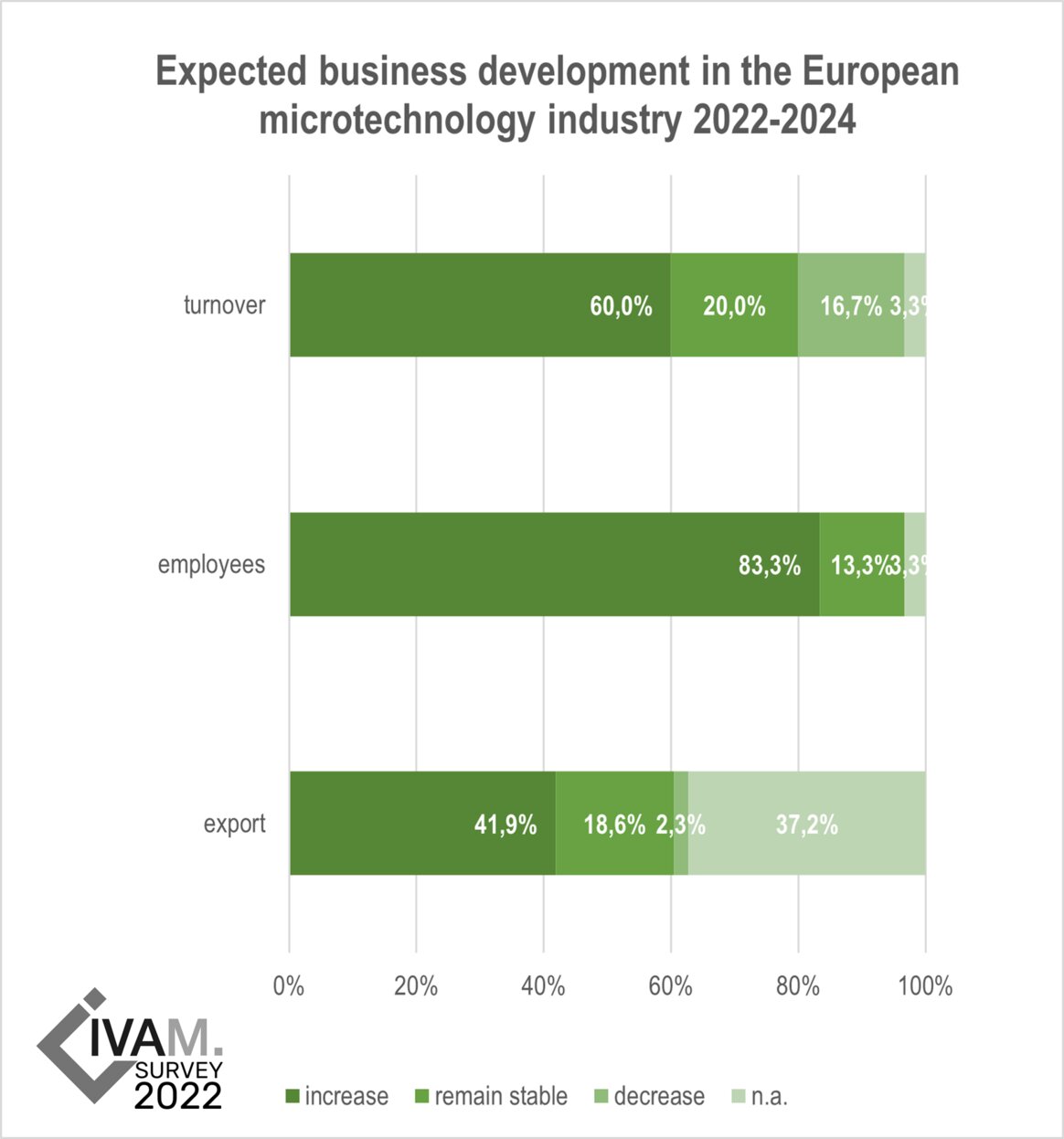

With regard to the economic development of the next three years (2022-2024), the companies surveyed are optimistic. The majority assumes that both the number of employees and sales will increase. It should be noted that these statements were made before the outbreak of the war in Ukraine - it remains to be seen whether these plans of the organizations will materialize.

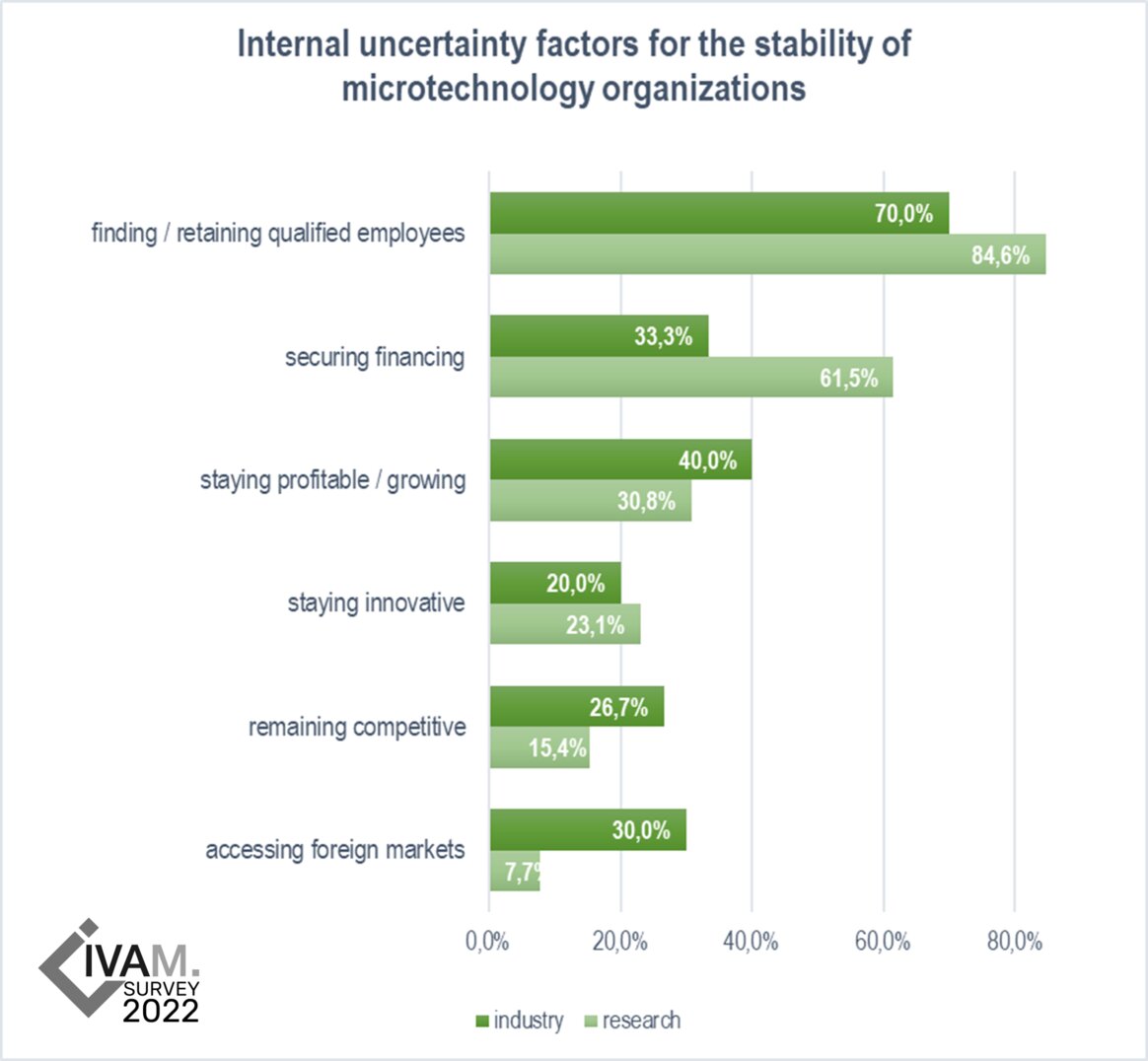

The competition for skilled workers is the dominant topic that concerns both companies and research institutes. 70% of the companies and as many as 84.6% of the research institutes perceive this as the greatest organizational challenge in the next three years. Securing profitability and access to foreign markets are uncertainty factors primarily for the companies surveyed (40.0% and 30.0%, respectively), while research institutes perceive securing funding in particular as a challenge (61.5%).

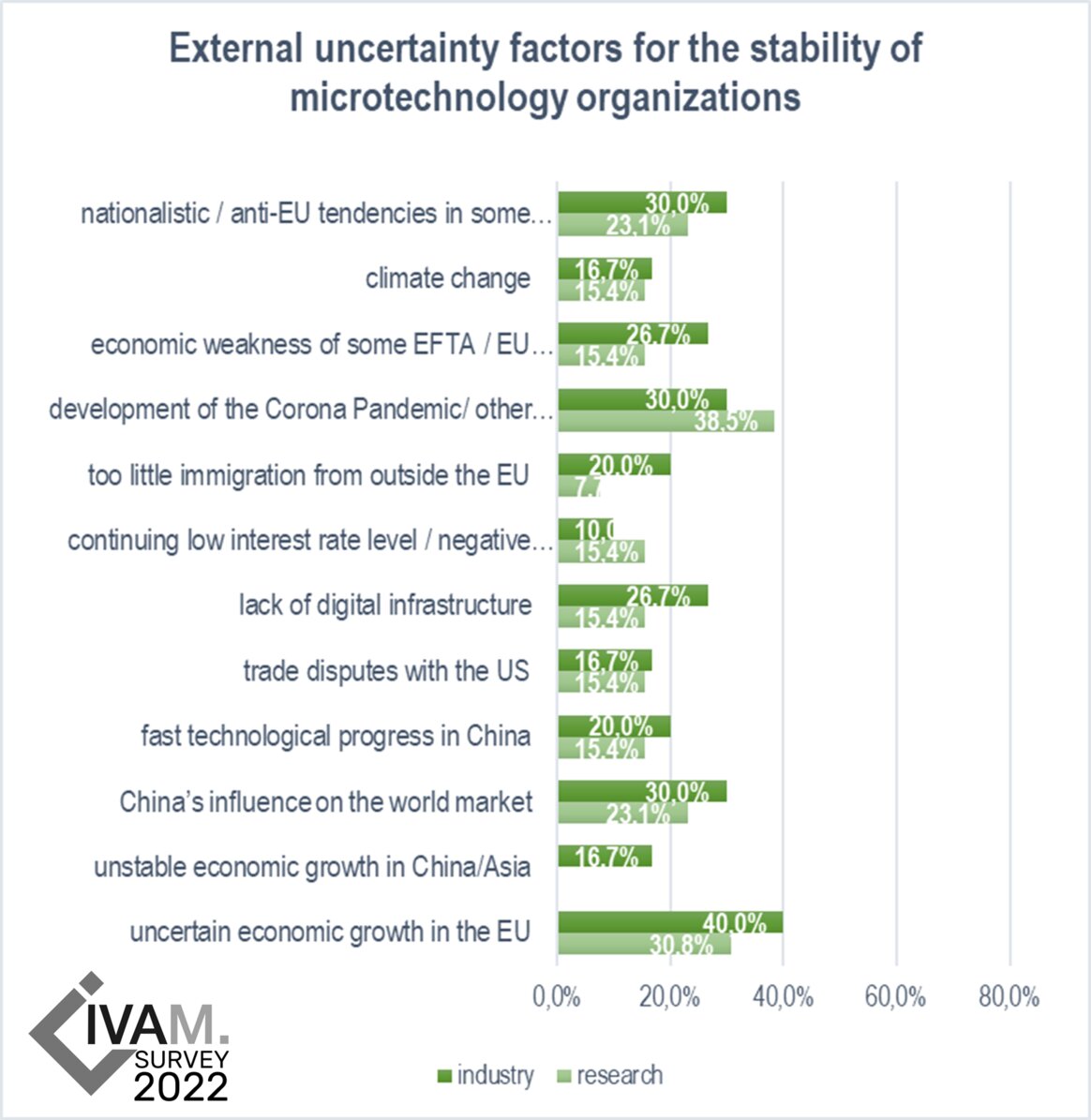

Developments in the European Union are the biggest factor of uncertainty, especially for companies. This relates both to the point of nationalistic tendencies in some EU states (27.9%) and to the uncertain economic development in the EU (37.2%).

The development of the Corona pandemic or other pandemics also causes concern - to a significantly greater extent for research institutions (38.5% and 30%, respectively).

Companies, in turn, are more concerned about China's influence on the world market. 30% of the companies consider this to be an external uncertainty factor. (Economic) cooperation with totalitarian systems is not predictable, see the current situation with Russia. Many companies are therefore increasingly focusing on democratic systems and prefer the market in the USA (see below).

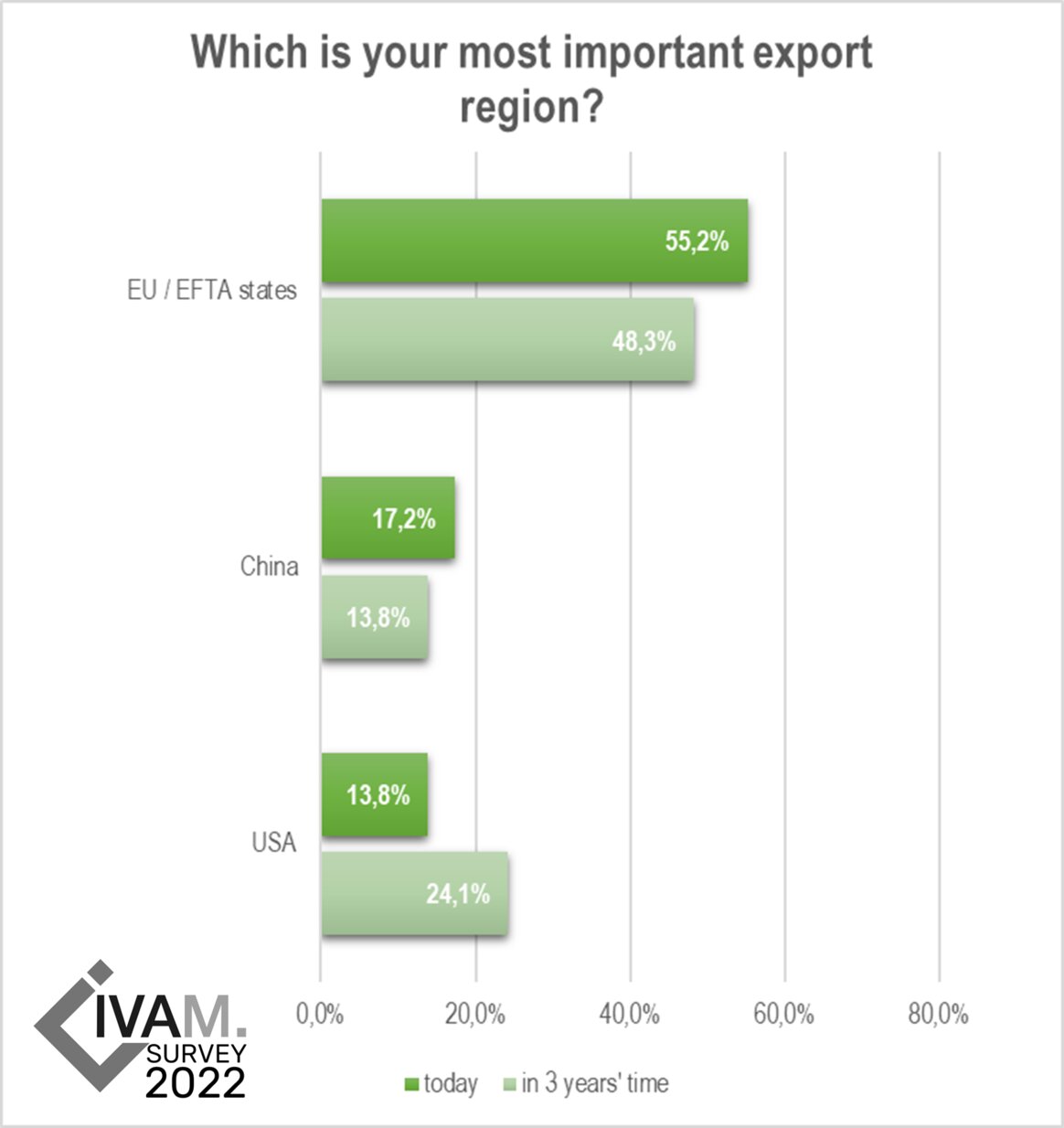

As in previous years, foreign trade at the beginning of 2022 is heavily focused on the EU/Europe: for 55.2% of companies, this is the most important export region.

The companies expect an increase in exports to the USA. At the moment, the USA is the most important market for 13.8% of companies, placing it behind China with 17.2% today (at the beginning of 2022). According to the companies, this distribution will reverse in the near future. Exports to the USA are expected to increase over the next three years (24.1%), while deliveries to China will decline (13.8%). The USA is expected to provide more stable economic relations and is adapting its business relations accordingly.

If you would like more information about this survey or would like to learn more or about our network, please feel free to contact me by mail or by phone at +49 (0) 231 9742 7090.

For more than ten years, the IVAM Microtechnology Network has been asking the microtechnology industry in Europe at the beginning of each year about its economic situation, strategies and trends. In February/March 2022, more almost 3,000 companies and research institutes in Europe have been asked about their economic situation and expectations, their international activities, market and application trends, drivers for innovation, and uncertainty factors for the stability of their organization.